I. Description

Forward foreign exchange settlement and sale business refers to that a customer signs a forward exchange settlement or sale agreement with ICBC, agreeing on the foreign currency type, amount, exchange rate and term for settlement or sale to be conducted over two days after execution of agreement; and, upon the foreign exchange receipts or disbursements on the delivery date, the exchange settlement or sale business will be handled on the basis of the foreign currency type, amount and exchange rate as agreed in the forward foreign exchange settlement and sale contract.

II. Target Customers

The product is applicable to corporate legal person, enterprise legal person, public institution legal person and social organization legal person duly registered in the People’s Republic of China (excluding Hong Kong, Macao and Taiwan) with needs and taking hedging as the business purpose, as well as overseas financial institution legal persons duly registered in overseas countries/regions and conducting RMB bond investment business in the China interbank market through ICBC, such as commercial banks, insurance companies, security companies and fund management companies.

III. Functional Features

1. Forward foreign exchange settlement and sale business is the most fundamental derivative tool of exchange rate, and the trading structure is simple and clear, and easily understandable.

2. It is a mature product, and the customers can ward off exchange rate risks on the basis of the future situation of foreign exchange receipts and disbursements and the expectations about the exchange rate market.

3. It can be conveniently combined with other products, and the customers can thereby enhance the returns or reduce the financial cost.

IV. ICBC Advantages

1. Diversified product lines

ICBC has the leading product R&D and risk management capabilities in the banking industry, and is able to provide comprehensive hedging tools against forward exchange rate risks to the customers, including diversified forward foreign exchange settlement and sale products and portfolios such as fixed-term forward exchange, optional forward exchange, parity forward exchange and super forward exchange, and thus meet customers’ demands fully.

2. Customized product design

ICBC’s forward foreign exchange settlement and sale business supports eleven types of foreign currencies, i.e., US Dollar, Japanese Yen, Euro, British Pound, Hong Kong Dollar, Australian Dollar, Canadian Dollar, Swiss Franc, Danish Krone, Singapore Dollar and Ruble, and supports forward foreign exchange settlement and sale business with different terms; furthermore, the customers can apply for special means of delivery such as advance delivery, rolling-over, partial delivery and delivery in batches in order to meet the customers’ operating cash flow demand.

3. High-quality product management

ICBC’s forward foreign exchange settlement and sale product can regularly provide transaction evaluation reports, and provide subsequent dynamic management services according to the market quotations and the customers’ demands.

4. Flexible credit extension mechanism

ICBC’s credit mechanism for forward foreign exchange settlement and sale is flexible, and the customers can choose freely to use special credit derivatives or pay a certain margin.

V. Qualification

The customers with foreign exchange receipts and disbursements under the current account, those with the needs to repay the funds such as the Bank’s self-operated foreign exchange loans, the overseas loans registered in SAFE, foreign exchange receipts and disbursements for ODI registered in SAFE, and foreign exchange capital income of foreign-invested enterprises registered in SAFE, and the customers with foreign exchange receipts and disbursements under the financial account, are qualified to apply for the business.

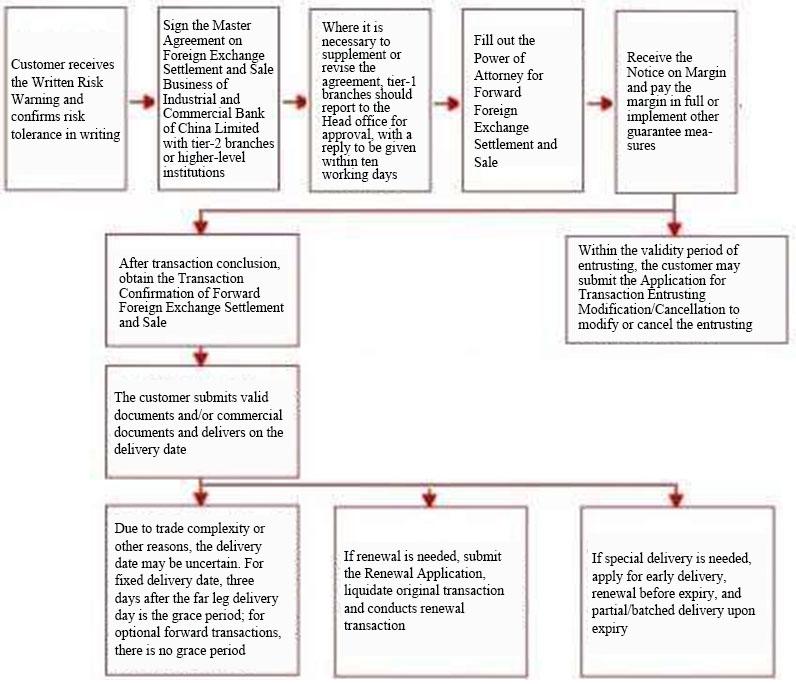

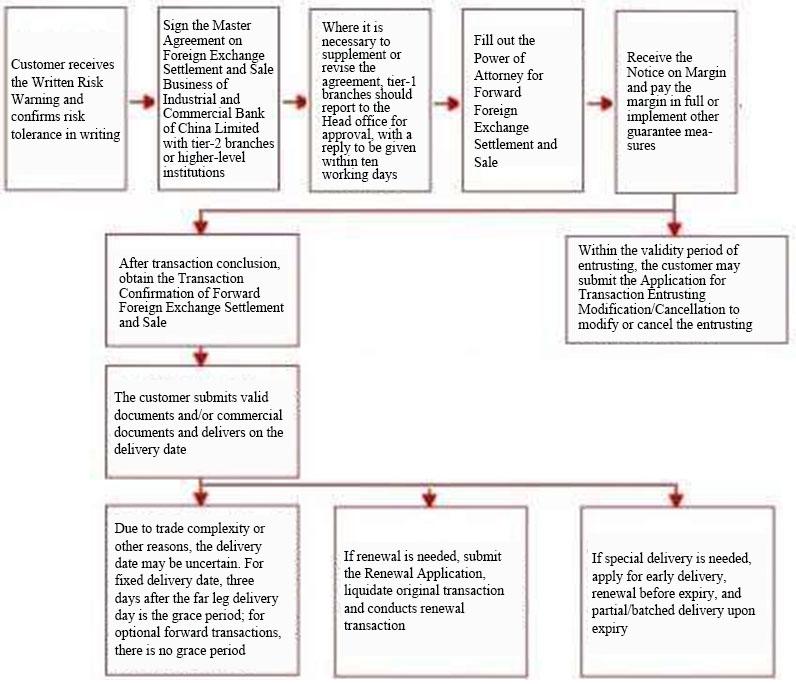

VI. Application Process

1. Preparations

(1) Customer evaluation: before a customer applies for the forward foreign exchange settlement and sale business, ICBC will carry out the derivatives trading suitability evaluation on the customer. ICBC will accept the entrustment only when the customer meets the acceptance conditions set by ICBC and have the ability to withstand the risks in forward foreign exchange settlement and sale according to the suitability evaluation.

(2) Signing a master agreement: After passing the suitability evaluation, the customer signs the Industrial and Commercial Bank of China Master Agreement on Foreign Exchange Settlement and Sale with ICBC.

2. Business processing

(1) Trading authorization: the customer is not allowed to conduct any transaction until it has fully paid the margin or has taken other guarantee measures. During the validity period of trading authorization, the customer can apply for amendment or cancellation of the trading authorization.

(2) Closing of transaction: after closing of transaction, ICBC will issue a transaction certificate to the customer.

3. Delivery

(1) Delivery on the delivery day: on the delivery date, the customer shall handle the delivery business with valid vouchers and/or commercial documents. For the forward foreign exchange settlement and sale business with a fixed delivery date, the 3 working days following the delivery date is set as the grace period, and the delivery handled during the grace period shall be construed as due performance of the contract. No grace period is offered for the optional forward transaction.

(2) Processing of special delivery: the customer can apply for special delivery such as liquidation or extension, advance delivery, roll-over before maturity, partial delivery upon maturity and delivery in batches. If any loss incurred by special delivery, it shall be compensated by the customer; if any profit gained from special delivery, it shall be temporarily saved into the margin account of the customer, and paid to the customer after due performance of the agreement.

4. Extension

A customer can apply for transaction extension on the delivery date or before maturity of the grace period, and specify the extension times and term. In cases of extension of forward foreign exchange settlement and sale, the customer may request ICBC to liquidate the original transaction at the original agreed price or the current trading price for foreign exchange settlement and sale of ICBC, and then conduct extension transactions with ICBC. When the customer requests for liquidation of the original transaction at the trading price for foreign exchange settlement and sale offered by ICBC at the price of extension, any loss resulting from the difference of exchange rate between the agreed price and the liquidation rate shall be compensated fully by the customer before the extension can be accepted; any profit resulting therefrom shall be temporarily saved into the margin account of the customer, and returned to the customer after due performance of the customer upon maturity of extension transaction. When the customer requests for liquidation of the original transaction at the original agreed price, ICBC will grant extension at the original price after collecting the margin or deducting the special credit for derivatives trading by the same amount according to regulations related to credit occupation of RMB forward settlement and sale. No profit or loss will arise in the liquidation. But the price of new extension contract may be higher or lower than the forward price.

5. Handling of default. Should the customer fail to fulfill the payment obligation as agreed, it shall be construed as a default event. In the case of a default event, ICBC is entitled to take necessary measures to deal with the customer’s existing transactions; if any loss of ICBC is incurred by the customer’s default, the loss shall be borne by the customer, and deducted directly from the customer’s margin account or other accounts; if any profit is gained, it shall be dealt with according to relevant business principles.

VII. Service Channels and Hours

The forward foreign exchange settlement and sale business can be handled through outlets and electronic banking. The transaction time is dependent on the regulatory rules and business needs. Usually the service hours are as follows except for legal holidays:

1. Operating outlets

From 9:30 to 18:00 from Monday to Friday (Beijing time)

2. Electronic banking channel

From 9:30 to 23:30 from Monday to Friday (Beijing time)

Please consult local operating outlets or 95588 for details.

VIII. Operation Guide

IX. Examples

In May 2016, a corporate customer engaged in export business to receive a payment for goods amounting to USD20 million in twelve months; considering that there greater fluctuation in the exchange rate of RMB at present, and in order to hedge against the financial risk brought by the fluctuations of exchange rate market, the customer made a forward exchange settlement transaction maturing in twelve months with ICBC amounting to USD20 million, with the agreed forward exchange rate of USD to RMB being 6.72. In May 2017, the transaction became due, and the customer sold the USD at the agreed forward exchange rate of 6.72 and bought the equivalent RMB.

Assuming that the spot exchange rate of USD to RMB on the maturity date is 6.60, the customer will enjoy the benefits brought by the previously locked exchange rate, and reduce the financial cost by RMB2.4 million (RMB 20 million×(6.72-6.60)=2.4 million); assuming that the spot exchange rate is 6.80, the customer will bear the risk brought by the previously locked exchange rate, and pay the increased financial cost of RMB1.6 million (RMB 20 million×(6.80-6.72)= 1.6 million); however, since the customer has hedged against the risk brought by changes in exchange rate by the forward foreign exchange settlement and sale business, and stabilized the future cash flow, the effectiveness of financial cost management will not be affected.

X. Frequently Asked Questions

i. In the case of rolling-over, submit an Application for Rollover, close the existing transactions and reach the extension transaction:

1. In the case of special delivery, apply for advance delivery, roll-over before maturity, partial delivery upon maturity or delivery in batches.

2. The customers can apply to ICBC for forward foreign exchange settlement and sale business for the funds of foreign exchange receipts and disbursements under the following accounts:

(1) For repaying the Bank’s self-operated foreign exchange loans;

(2) For repaying the overseas loans registered in SAFE;

(3) Foreign exchange receipts and disbursements of ODI registered in SAFE;

(4) Foreign exchange capital income of foreign-invested enterprises registered in SAFE;

(5) Foreign exchange receipts of domestic institutions publicly listed abroad registered in SAFE;

(6) Other foreign exchange receipts and disbursements as approved by SAFE.

ii. The customer shall submit relevant qualification certificates and compliant and valid documentary evidence, cooperate with the Bank in due diligence, and sign related agreements and confirmation letters.

iii. On the premise of signing related agreements and confirmation letters, the customers can submit an official letter of authorization to corresponding branches, which will then transfer it to the Head Office for confirmation; upon receipt of the confirmation from the Head Office, the corresponding branches will issue transaction certificates to the customers, which will serve as the official transaction documents.

iv. Upon expiry, the customer shall perform its delivery obligation according to the agreement. In cases where the delivery time or mode needs to be adjusted due to the complicacy of trade or any other reasons, the customer may apply to the Bank for liquidation or extension, advance delivery, extension prior to expiry, partial delivery upon expiry or delivery in lots.

XI. Risk Prompt

The risk in the forward foreign exchange settlement and sale business is mainly reflected as market risk, and the forward transaction proposed by the customers may be subject to floating P/L owing to the fluctuations of exchange rate. In case of losses, the customer has to assume according losses eventually. However, if the forward foreign exchange settlement and sale business is completely matched with the basic assets of hedging, the floating P/L will not affect the effectiveness of management.

XII. Notes

Forward foreign exchange settlement and sale business has high requirements on the transaction timeliness, so the loss caused by market price fluctuation shall be avoided in the operation.

XIII. Definitions

1. Forward foreign exchange settlement and sale business with fixed term refers to that the agreement of forward foreign exchange settlement and sale signed between the customer and the Bank clearly specifies a predetermined working day in future when the delivery of funds will be handled as per the agreed exchange rate.

2. Optional forward transaction refers to that the agreement of forward foreign exchange settlement and sale signed between the customer and the Bank clearly specifies that the customer is entitled to demand the Bank for delivery of funds as per the agreed exchange rate on a random working day (to be notified to the Bank one business day in advance) during a certain period in future.

3. Parity forward foreign exchange settlement and sale business refers to that the agreement of forward foreign exchange settlement and sale signed between the customer and the Bank clearly specifies that the same exchange rate will be applied in the cash flow during a certain period in future for the Bank to handle the delivery of funds.

4. Super forward foreign exchange settlement and sale business refers to the forward foreign exchange settlement and sale business with the value date at least one year later.

Note: The information given on this page is for reference only. See the announcements and rules of local outlets for details.

|